Introduction In today’s rapidly evolving business landscape, the ability to effectively manage...

Corporate Taxation in Europe: A Comprehensive Overview

Corporate Taxation in Europe: A Comprehensive Overview

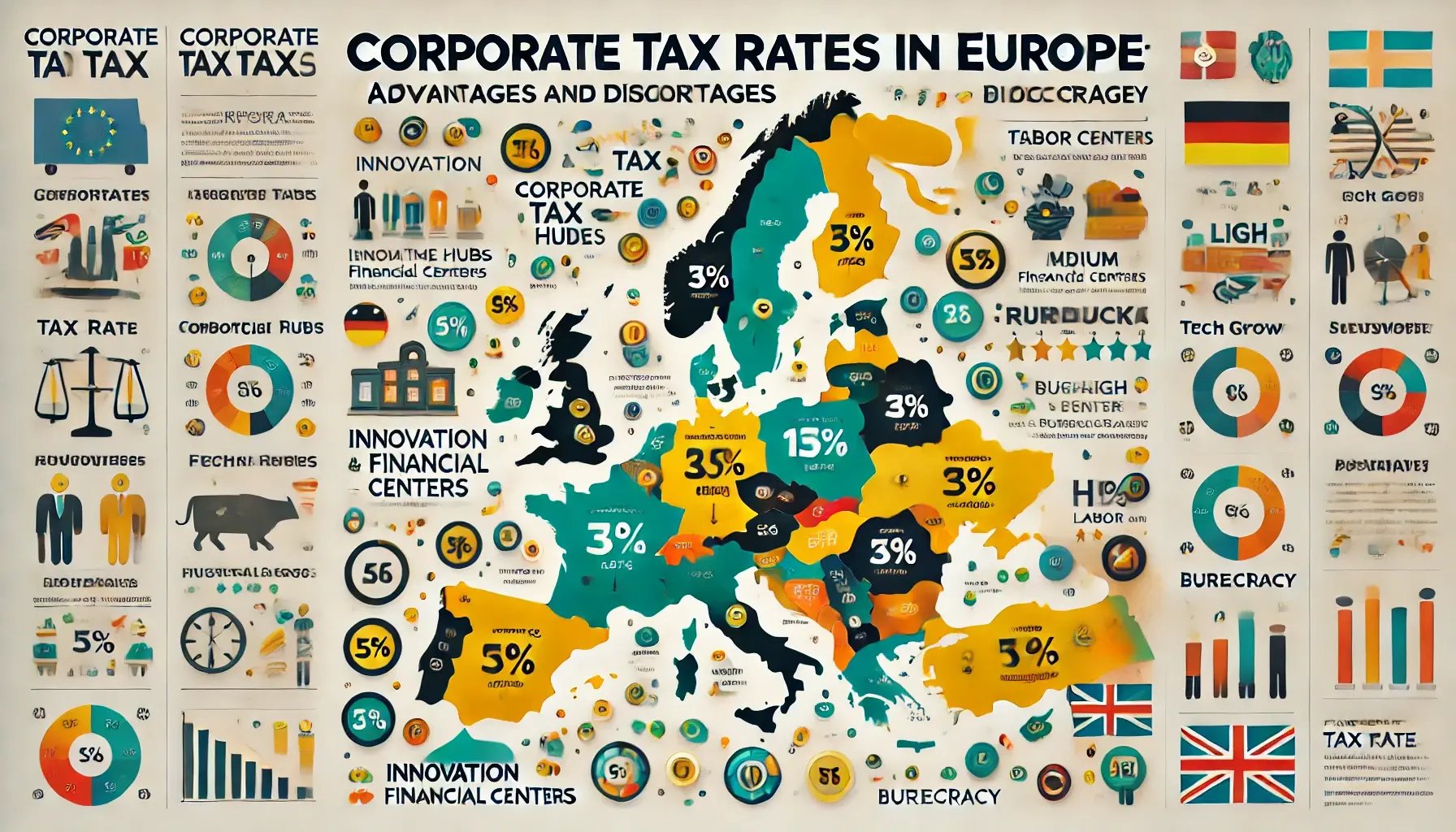

Corporate taxation is a cornerstone of economic strategy for countries across Europe. Each nation has designed its corporate tax framework to align with its economic policies, priorities, and competitive positioning in the global market. While some countries leverage low tax rates to attract foreign investment, others maintain higher rates to support extensive public services and social programs. This article delves into the corporate tax rates across Europe as of 2025, exploring the advantages and challenges businesses face in different jurisdictions.

1. Corporate Tax Rates in Europe

Corporate tax rates vary significantly across Europe, ranging from single-digit percentages in some nations to rates exceeding 30% in others. These rates often reflect broader economic strategies:

- Low-Tax Jurisdictions: Countries like Ireland (12.5%) and Hungary (9%) are known for their business-friendly tax environments, attracting multinational corporations and startups. However, such low rates can draw scrutiny from international regulators and organizations advocating for global tax harmonization.

- Moderate-Tax Countries: Nations such as Germany (15% corporate tax + trade tax, averaging around 30%) and the Netherlands (25.8%) strike a balance between competitive tax rates and robust public services, appealing to businesses seeking stability and skilled labor.

- High-Tax Jurisdictions: Countries like France (25%) and Italy (24%, plus regional taxes) maintain higher rates, offset by access to large consumer markets, extensive infrastructure, and incentives for innovation and green initiatives.

2. Factors Shaping Corporate Tax Policy

European nations design their tax systems to achieve various objectives, including:

- Economic Growth: Low tax rates and incentives for R&D, tech startups, and sustainable energy often drive investment and innovation.

- Social Equity: Higher tax revenues support comprehensive social welfare systems, public healthcare, and education.

- Global Compliance: Many countries adhere to OECD initiatives, such as the Base Erosion and Profit Shifting (BEPS) project and the global minimum tax rate, shaping their tax policies to align with international standards.

3. Advantages of Corporate Tax Strategies

- Low-Tax Countries: Attracting foreign direct investment (FDI) is a significant advantage, with corporations benefiting from reduced operational costs and tax liabilities.

- Moderate and High-Tax Countries: Companies often gain access to highly skilled workforces, advanced infrastructure, and strong legal protections, compensating for higher tax burdens.

- Specialized Incentives: Many countries offer sector-specific tax breaks or credits, such as for renewable energy, digital transformation, or regional development.

4. Challenges and Risks

- Tax Competition: The disparity in tax rates can lead to "race-to-the-bottom" dynamics, where countries compete by lowering rates, potentially undermining public revenues.

- Regulatory Scrutiny: Low-tax jurisdictions face increasing scrutiny from the EU and global bodies, with potential reputational risks for companies headquartered in these areas.

- Complex Compliance: Navigating differing tax systems, compliance requirements, and reporting standards across borders can increase administrative burdens and costs for businesses.

5. Future Trends in European Corporate Taxation

The European corporate tax landscape is undergoing transformation, influenced by economic recovery efforts, global tax reforms, and sustainability goals:

- Implementation of the OECD Global Minimum Tax: This initiative aims to establish a 15% minimum corporate tax rate globally, reducing tax base erosion and profit shifting.

- Digital Taxation: Countries are introducing digital services taxes to address the revenue generated by tech giants in markets where they do not have a physical presence.

- Incentives for Green Initiatives: Tax policies increasingly favor sustainable and environmentally friendly business practices, encouraging investment in renewable energy and carbon reduction technologies.

6. Country-Specific Highlights

- Ireland: Known for its 12.5% corporate tax rate, Ireland attracts tech giants like Google and Apple but has committed to adopting the OECD global minimum tax for large multinationals.

- Germany: With a comprehensive tax structure including trade tax, Germany balances moderate tax rates with significant R&D incentives and a highly skilled labor market.

- Switzerland: Offers a varied tax regime across cantons, with rates averaging around 14.93%, appealing to multinational corporations and private wealth.

__________________________________________________________________________________________________________

Corporate taxation in Europe presents a complex but strategically significant factor for businesses. While low-tax jurisdictions offer financial savings, moderate and high-tax countries provide stability, infrastructure, and skilled labor. As global initiatives like the OECD's minimum tax rate reshape the landscape, businesses must stay informed and adaptable to align their strategies with evolving tax policies.

Understanding the nuances of European corporate taxation is crucial for businesses aiming to maximize opportunities while managing risks effectively. Whether entering new markets or optimizing existing operations, aligning tax strategy with long-term objectives can ensure sustainable growth and success in the dynamic European economy.

Western Europe

Netherlands

-

Corporate Tax Rate: 25.8% (19% for taxable amounts below €200,000)

-

Advantages: The Netherlands offers a business-friendly environment, a strong international trade network, and robust legal protections.

-

Disadvantages: The relatively high corporate tax rate for large profits can be a drawback for some companies.

United Kingdom

-

Corporate Tax Rate: 25.0%

-

Advantages: The UK has a stable legal system, a vast financial sector, and favorable treaties with many countries.

-

Disadvantages: Post-Brexit trade complexities and regulatory changes may deter some investors.

Belgium

-

Corporate Tax Rate: 25.0%

-

Advantages: Offers generous R&D tax incentives and a strategic location for accessing EU markets.

-

Disadvantages: High labor costs and a complex tax compliance system.

Ireland

-

Corporate Tax Rate: 12.5%

-

Advantages: One of the lowest corporate tax rates in Europe, Ireland is a hub for multinational tech and pharmaceutical companies.

-

Disadvantages: Limited domestic market and reliance on foreign investment.

Northern Europe

Denmark

-

Corporate Tax Rate: 22.0%

-

Advantages: Transparent governance and a highly skilled workforce.

-

Disadvantages: High labor costs and a small domestic market.

Sweden

-

Corporate Tax Rate: 20.6%

-

Advantages: Strong infrastructure and innovation support.

-

Disadvantages: High cost of living and labor expenses.

Finland

-

Corporate Tax Rate: 20.0%

-

Advantages: Advanced technology sector and a stable economy.

-

Disadvantages: Geographical remoteness and a small domestic market.

Eastern Europe

Hungary

-

Corporate Tax Rate: 9.0%

-

Advantages: The lowest corporate tax rate in Europe and a growing industrial base.

-

Disadvantages: Corruption concerns and limited transparency.

Bulgaria

-

Corporate Tax Rate: 10.0%

-

Advantages: Low tax rate and competitive labor costs.

-

Disadvantages: Infrastructure challenges and low purchasing power.

Poland

-

Corporate Tax Rate: 19.0%

-

Advantages: Large domestic market and increasing foreign investments.

-

Disadvantages: Bureaucratic hurdles and inconsistent regulations.

Southern Europe

Italy

-

Corporate Tax Rate: 27.8%

-

Advantages: Access to a large consumer market and robust industrial sectors.

-

Disadvantages: High bureaucracy and labor costs.

Portugal

-

Corporate Tax Rate: 30.5%

-

Advantages: Growing tech startup ecosystem and access to EU funding.

-

Disadvantages: High tax rate and limited labor pool.

Spain

-

Corporate Tax Rate: 25.0%

-

Advantages: Diverse economy and access to Latin American markets.

-

Disadvantages: High unemployment rates and complex tax rules.

Central Europe

Germany

-

Corporate Tax Rate: 29.9%

-

Advantages: Strong manufacturing base and a highly skilled workforce.

-

Disadvantages: High labor costs and stringent regulations.

Austria

-

Corporate Tax Rate: 25.0%

-

Advantages: Stable economy and proximity to Central and Eastern European markets.

-

Disadvantages: High operational costs.

Czech Republic

-

Corporate Tax Rate: 19.0%

-

Advantages: Strategic location and competitive labor costs.

-

Disadvantages: Limited domestic market size.

Small Economies

Luxembourg

-

Corporate Tax Rate: 24.9%

-

Advantages: A leading financial hub with favorable treaties.

-

Disadvantages: High living costs and regulatory scrutiny.

Malta

-

Corporate Tax Rate: 35.0%

-

Advantages: Significant tax refunds for foreign shareholders and a strong gaming sector.

-

Disadvantages: Limited market size and dependency on imports.

Conclusion

Europe presents a diverse landscape for corporate taxation, ranging from the ultra-low rates of Hungary (9.0%) to the high rates of Malta (35.0%). Companies must carefully evaluate the tax regimes alongside other factors such as labor costs, market access, and infrastructure when deciding where to operate. Consulting with tax professionals is crucial to navigating the complexities of each jurisdiction and optimizing business strategies.